Take a look at the 'duck curve' in Australia's electricity demand, driven by increasing rooftop solar installations, and explores its implications for grid stability, pricing dynamics and opportunities for flexible load management.

Our previous post looked at the difference between what a residential solar owner in London might be paid under the various SEG export tariffs and what that energy would be worth on the balancing market. We found that the export tariffs on offer were much lower than both the very high wholesale prices and the import tariffs (for energy consumption rather than generation) that the suppliers are offering to customers.

However, installing a PV system could still be a good investment for households who self-consume the majority of generated energy and so reduce the amount of energy purchased from their supplier. With the current energy price guarantee at an eye watering 34p/kWh from October 1st, solar is becoming an increasingly attractive option for many households.

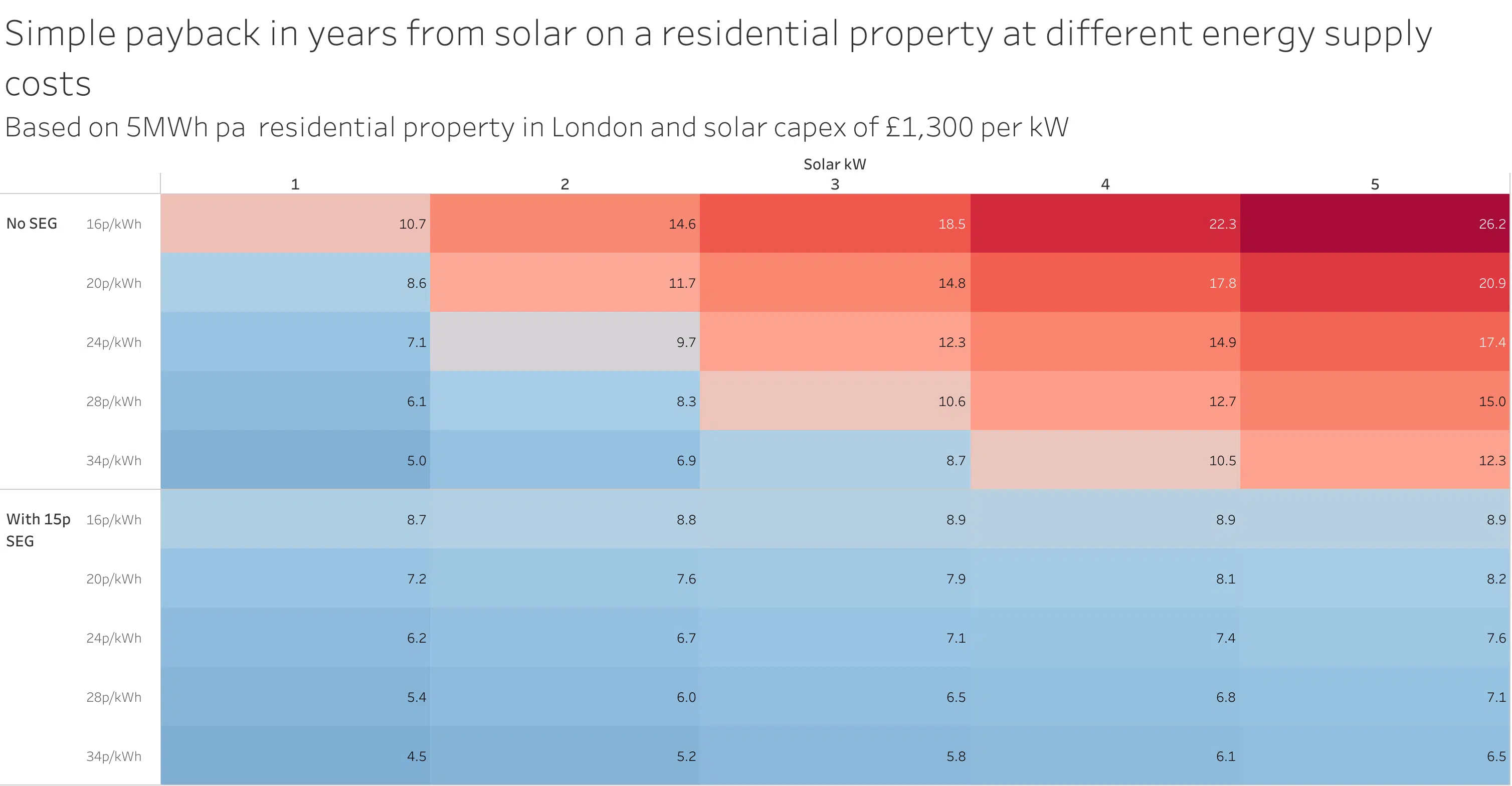

We modelled out the following assumptions in the Gridcognition software to see how long it’d take to pay off the investment in a new residential solar system:

The payback period is very sensitive to both the import and export tariffs, as you may expect. At one extreme, a 5kW array with a 16p/kWh import tariff and no export tariff would take 26.2 years to pay off, which is beyond the rated lifespan of many panels. At the other extreme, a 1kW array with 34p/kWh import and 15p/kWh export would be paid off in 4.5 years.

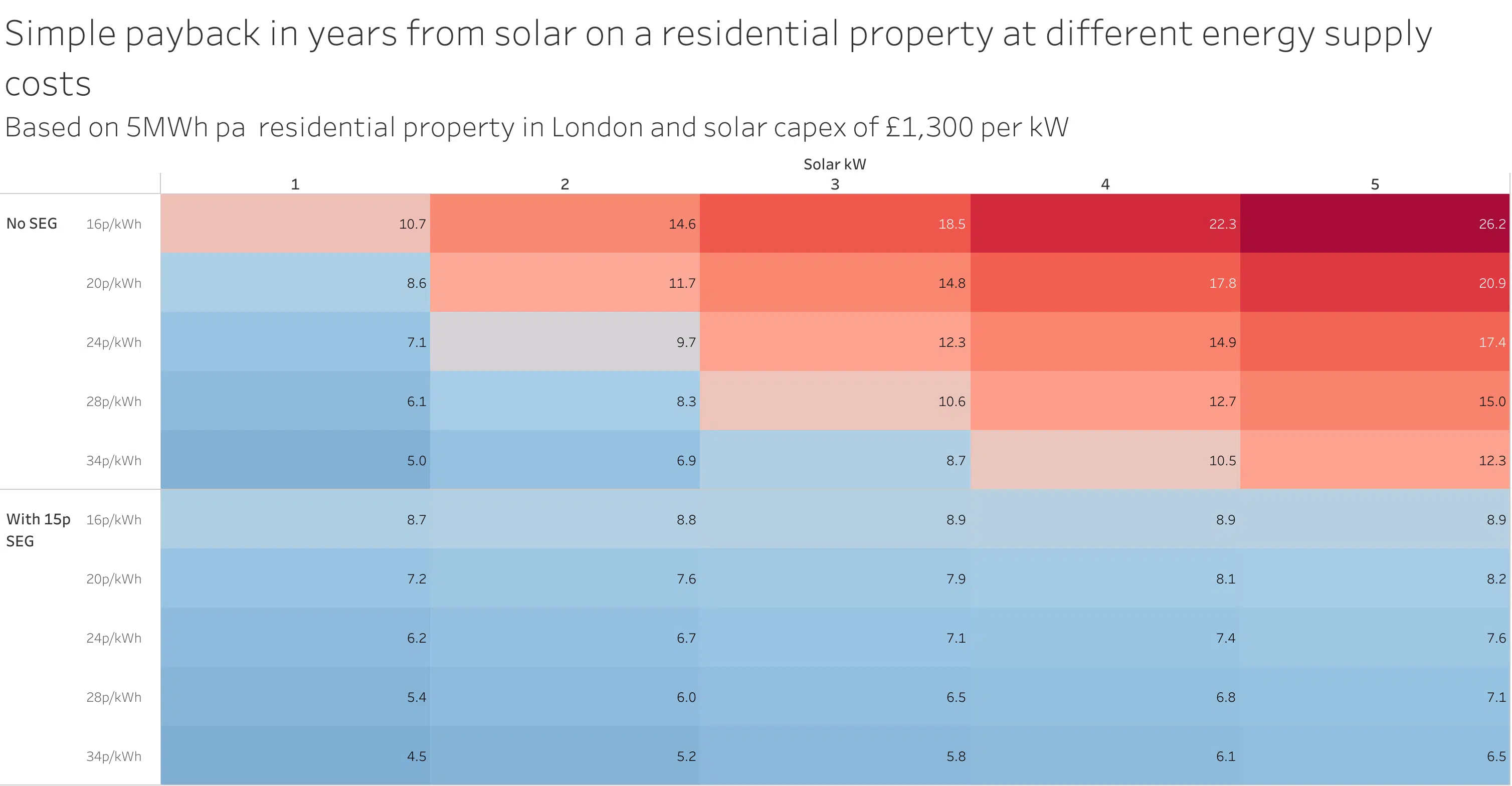

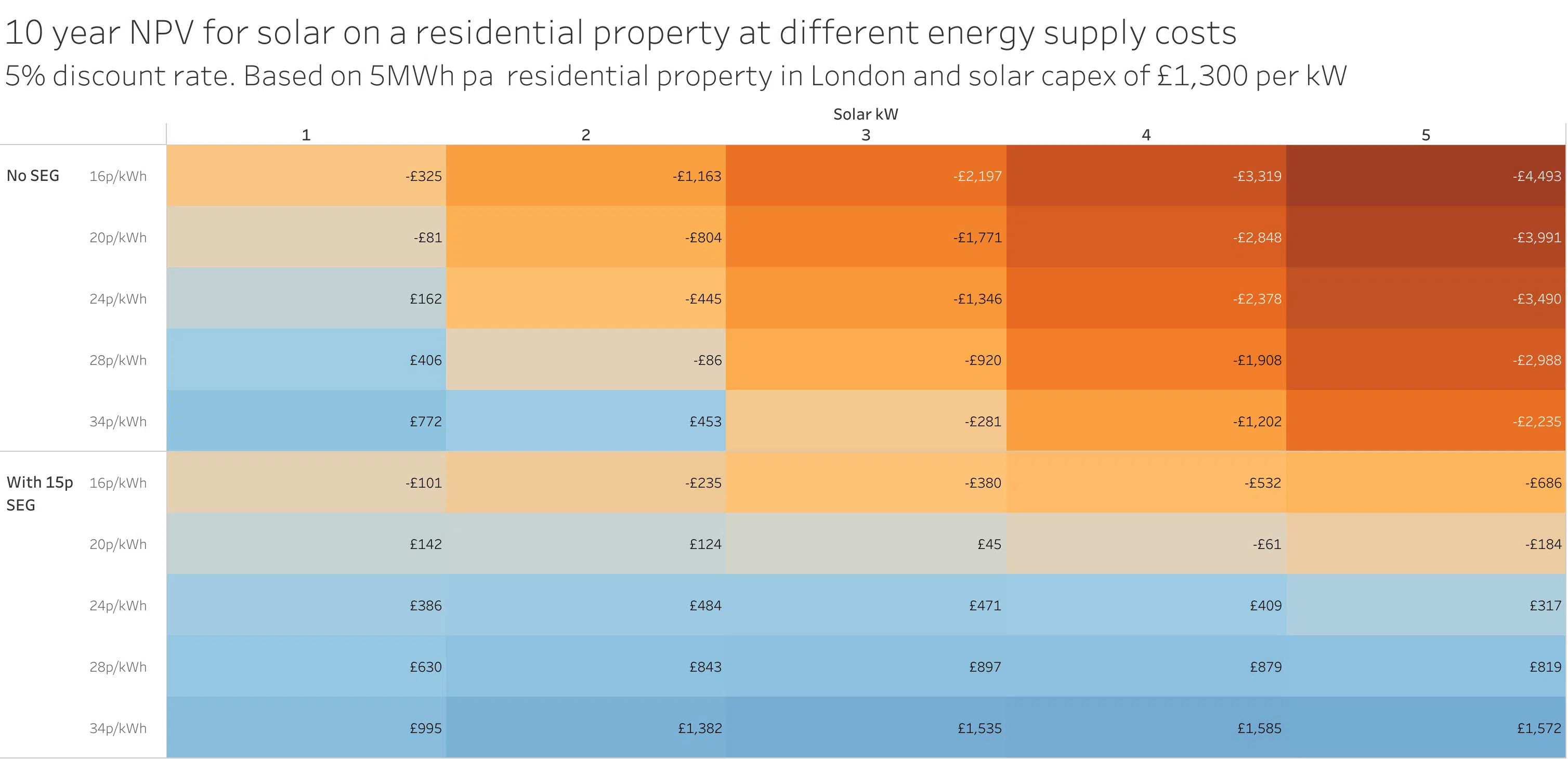

Since payback time will often favour lower capex at the expense of longer-term value, let’s also take a look at NPV after 10 years, based on a 5% discount rate:

Even without an export tariff, any size of solar array is a worthwhile investment if import tariffs stay at their elevated rate of 34p/kWh and excess generation can be sold at 15p/kWh. For systems without any export, only arrays sized at 1kW or 2kW will have a positive NPV after 10 years.

Here’s a closer look at the energy flows for a 3kW system during the month of June.

In a typical week in summer, the PV system is exporting significant amounts of energy to the grid, and also reducing peak demand by just under one third.

Even in winter, the PV system is exporting some excess generation to the grid on sunny days, but isn’t making much of a dent on consumed energy or peak demand.

Across the year, a significant portion of the house’s energy demands are met by the PV system.

Another way to answer the question of whether PV systems are a good investment is to look at whether new systems are actually being deployed. Fortunately, the Department of Business, Energy and Industrial Strategy publishes monthly figures of new solar capacity installations, broken down by deployment size.

Here’s the monthly small-scale (<50kW) installations in the UK over the past 12 years:

It’s been quite a rollercoaster for the UK residential solar industry! The peaks in early 2012 and 2016 coincide with changes to rates and rules of the FiT scheme, and the huge outlier in March 2019 lines up with the end of the scheme and the rush to get installations accredited before the deadline of April 1st. Since that date, small-scale solar installations have been growing steadily without subsidies, with just a small blip down in early 2020 during the COVID lockdowns and a noticeable uptick since the beginning of 2022.

Let’s zoom in on the last three years and compare installations with Australia, which has a much larger and more mature residential solar industry. We took June 2019 as a baseline to avoid any distortions caused by the ending of the FiT scheme, since it’s likely that many installations were brought forward to meet the deadline and inventory and sales pipelines would be drained for a few months afterwards.

The Australian data was taken from Sunwiz, and includes all systems up to 100kW. The comparison therefore isn’t exactly like-for-like, but is directionally correct.

Australia starts from a much higher baseline of 178 MW of installation per month. However, there’s only moderate growth in rate of installation, with ~200-300MW for most of the period. Still, that’s around 3GW of new installed capacity per year!

The UK, on the other hand, starts from a much lower baseline of 8MW in June 2019, but rises to 56MW in September 2022. That’s an increase of over 650%.

As energy wholesale prices continue to be elevated and volatile, and retail tariff rates reflect those high prices, households’ economic case for residential solar installations will only grow stronger. Even without feed-in tariffs or SEG tariffs that accurately reflect the fair value of exported energy, it’s likely that more and more households will install small-scale solar generation to save money on their energy bills.

At Gridcognition, we’re able to model and simulate DER deployments that include solar, wind, battery storage, EV chargers and other assets, across multiple sites, markets and jurisdictions. Contact us if you’d like help modelling your DER deployment!

Take a look at the 'duck curve' in Australia's electricity demand, driven by increasing rooftop solar installations, and explores its implications for grid stability, pricing dynamics and opportunities for flexible load management.

.png)

What would happen if you clad NEOM The Line in Photo-Voltaic material?

What is a solar fence and how does a solar fence stack up compared to conventional ground-mount solar in London and Sydney?