Pete Tickler uses Gridcog to test the impact of different battery control strategies by running near-identical versions of the site where the only thing that varies is the way the BESS is controlled.

The Frequency Control Ancillary Service (FCAS) markets of the National Electricity Market of Australia have been a hot topic in recent years — they’ve been a significant source of revenues for both utility-scale and distributed resources, including community and behind-the-meter batteries, demand response and virtual power plants.

The NEM has two types of frequency control markets — the six (soon to be eight) Contingency markets which arrest, stabilise and restore the system frequency after unexpected events like the loss of a power station or a large industrial load; and the two Regulation markets, one raise and one lower, which are used to maintain the frequency within normal limits by making small and constant adjustments between supply and demand in the system.

Participation in the Regulation markets is effectively limited to scheduled (typically large, above 5MW) assets which can receive control signals every 4 seconds from the system operator via SCADA.

The chart below comes from AEMO’s latest Quarterly Update and shows BESS revenues for the last few quarters.

The top two segments of the stack represent FCAS revenues. Whilst the majority of FCAS revenue has come from Contingency markets (dark green), the Regulation markets (light green) have been a consistent revenue contributor.

Regulation services are expected by many to make up an increasing proportion of battery revenues as Contingency markets become saturated.

Unlike Contingency FCAS Services, which are delivered autonomously and only require BESS assets to charge or discharge in the event of a serious deviation of frequency, and even then often for a very short amount of time, Regulation FCAS involves constant adjustments to the energy flows of a BESS.

These constant adjustments lead to material energy throughput which will impact on the physical degradation of the BESS as well as the opportunity to value stack Wholesale Energy Arbitrage and Network Support Services.

Gridcog supports modelling revenues from both Contingency and Regulation FCAS services. We recently added more flexibility and options to control how these market services can be modelled.

In the case of Regulation we wanted to provide users with sensible default assumptions for energy throughput associated with delivering these services, so we recently undertook some detailed analysis of historical market data. Here’s what we found.

We’ve looked at the actual utilisation of assets participating in Regulation FCAS for the last few years. The data is pretty interesting and not easily accessible, so we thought it was worth sharing what we found.

The charts below plots enablement quantities delivered by assets participating in the Raise and Lower markets in January 2023 by time of day.

The quantities are reflected as a utilisation percentage calculated as the average 5 min power charged/discharged divided by the power a unit was enabled for. The shaded area reflects min and max enablement quantities for each unit. The solid line the average for all units for each trading interval. The dotted line the average for all units for the month.

It’s clear from this data that assets participating in the Raise service were required to work a good deal harder than assets in the Lower service over the same period, with 22% of enabled capacity being called upon to discharge.

For BESS owners this is potentially material in terms of both energy costs and battery degradation — for example, a 1 MW unit enabled for one side of Regulation for a 24 hour period with an average of 20% utilisation will see 4.8 MWh of energy discharged. Over a year, for a 2-hour duration BESS that could mean over 850 battery cycles! When you consider a battery warranty often allows between 360 and 500 cycles a year it's clear this is not a low stakes play.

We've been enhancing our Gridcog software to better support ancillary services markets. This applies both to Australia and international markets like the UK and Europe. The improvements include accurate modelling of available capacity. Users can now adjust accepted or enabled capacity and utilised capacity. We've also implemented sensible defaults grounded in real-world performance.

If you’re interested in investing in assets that are looking to participate in frequency control markets then feel free to reach out an arrange a demo.

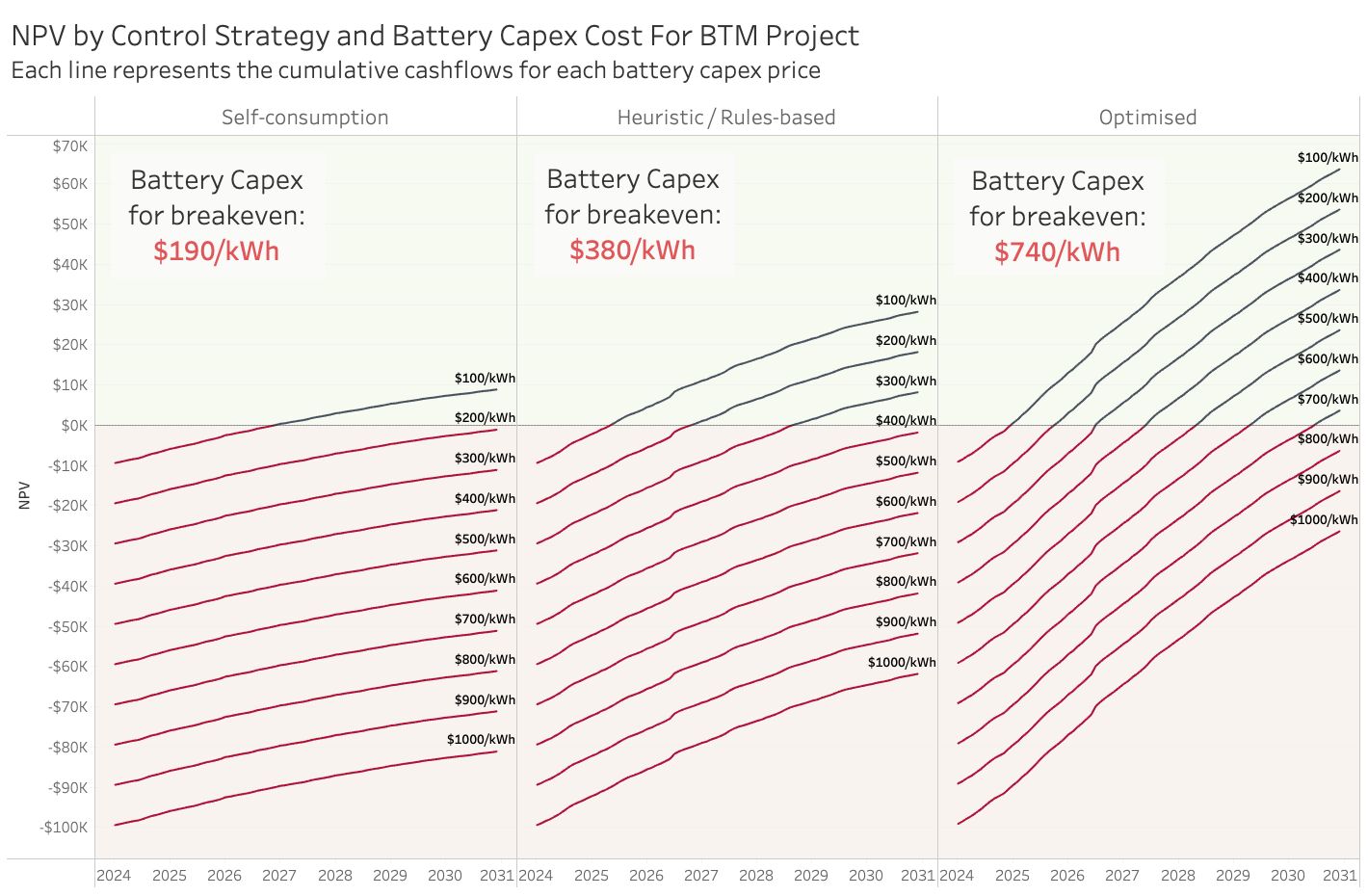

Pete Tickler uses Gridcog to test the impact of different battery control strategies by running near-identical versions of the site where the only thing that varies is the way the BESS is controlled.

Unlock the potential of hybrid solar and battery storage systems with our deep-dive into DC-coupled systems. Learn how they work, their advantages, and how they can increase energy exports and boost project revenues. This detailed guide provides insights into modelling complexities and how Gridcog can help you navigate and compare different solutions for effective decision-making in the clean energy sector

Comparing the commercial performance of a two hour and eight hour duration grid-scale battery in Australia's NEM