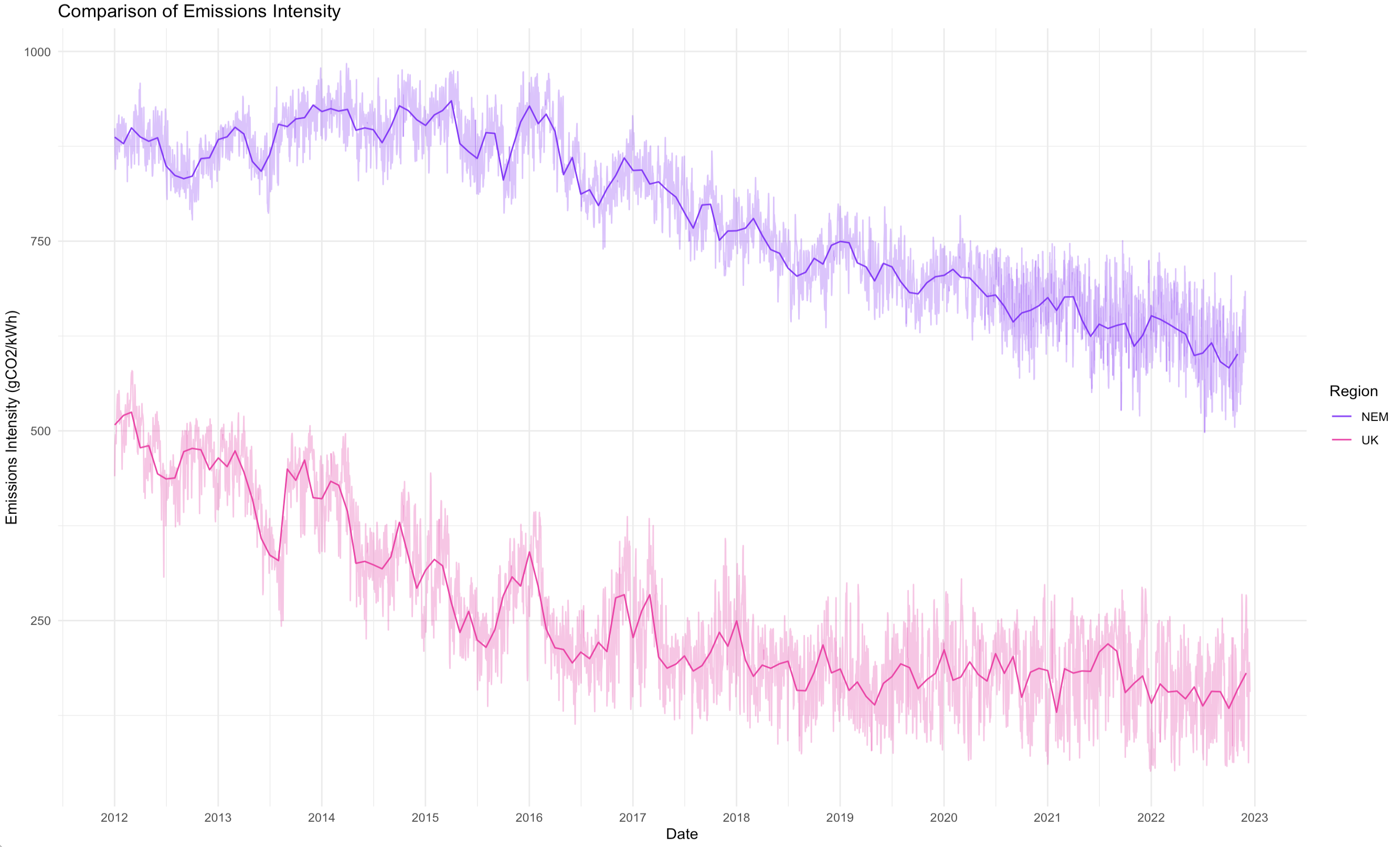

A look at how grid emissions intensity has changed over the last decade

Today, countries representing 78% of global GDP have pledged net-zero emissions by 2060. And we hope that this level of commitment will rise significantly before the end of this decade.

Energy from fossil fuels accounts for more than 70% of global emissions and, over the next thirty years or so, the world will need to replace tens-of-trillions-of-dollars worth of energy and transport infrastructure linked to fossil fuel supply chains.

Our view at Gridcog is that the majority of the replacement infrastructure will be smaller, smarter assets distributed throughout the built environment: a shift from big dumb machines to small smart machines.

Today, electricity is only around 20% of end-use energy, but this is likely to quadruple as we move towards net zero emissions and as we shift away from gas and fuel for transport, heating, and industrial processes (while total energy use will continue to grow).

Most of the remaining 20% of end-use energy is likely to be produced from renewable power through power-to-fuel and power-to-gas systems (aka synthetic fuel and green hydrogen), along with some continuing use of bio-gas and fossil-gas with carbon capture. As this shift progresses, the energy system and the power system will become largely synonymous.

At the same time, the stunning cost and performance improvements of modern inverter-based energy generation and storage systems will continue (solar PV, battery storage, and cousins).

Reference: Solars future is insanely cheap

One of the most remarkable characteristics of these new inverter-based energy systems is that they can scale down efficiently and can be installed close to loads to avoid delivery costs.

The technology to move electricity over long distances is improving, but there will always be challenges with congestion, energy losses, and high infrastructure costs. Transport (transmission and distribution) can often be as much as 50% or more of the delivered cost of electricity from large centralised generators.

While large on-shore and off-shore wind farms will provide bulk energy, (carried into load centres on high-voltage transmission lines), and our power system will continue to have centralised gas generators providing backup power for some time (but running increasingly rarely), it is going to be more efficient (and increasingly more prevalent) to generate, store, and use electricity entirely locally.

That’s why the balance of energy generation will shift from larger transmission-connected generators to smaller distribution-connected and behind-the-meter generators within local energy systems.

Local energy systems will take many different forms:

And across all of these local energy systems, electric vehicles will have an increasingly central role: as a new significant load; as a resource to balance energy generation and supply and regulate the power system; and as an alternative to ‘poles and wires’ for shifting energy to different parts of the macro power grid.

It used to be that around 60% of the cost of electricity was generation costs, and around 80% of that cost came from the fossil fuels used by generators. More electricity use meant more fuel use, and energy users were largely charged for electricity based on the volume of electricity they used.

For this reason, almost all retail electricity tariffs are volume-based. Initially, we had flat rates (c/kWh), and then time-of-use rates (2-part, 3-part and even more), and now, through increasing innovation, we have even more dynamic pricing reflecting the underlying volatility within wholesale energy markets.

But, as fossil fuels leave the energy system and more variable renewable energy sources enter the system, the price of the energy commodity will fall, relative to the total delivered cost of energy, and relative to fixed generation, transmission, and distribution infrastructure costs.

At the same time, the wholesale price of energy will become increasingly volatile (with not just price spikes, but increasingly frequent and prolonged price plunges). The power system will be ever more dependent on demand management services, ancillary market services, and local network services to maintain reliability and stability.

With solar and battery systems becoming cheaper, there will be an increasing incentive for energy users to ‘defect’ from the power grid because of these high fixed costs.

This could be mitigated by write-downs in the value of centralised network and generation infrastructure, on the basis that more self-supply by energy users means these assets have less value. Without write-downs the fixed cost of centralised infrastructure will need to be recovered over an ever-decreasing volume of energy supply, creating higher-prices and the dynamic we used to call the death spiral.

If incumbents seek to defer or avoid write-downs, then the power sector will need to find other ways of incentivising energy users to stay connected to the power grid for the common good.

Ten years ago, this incentive came from feed-in-tariffs for roof-top solar PV, often fixed by Government or regulators to encourage consumers to make what was then an otherwise uneconomical investment. We no longer require a subsidy as an incentive to install roof-top solar, and while exported solar energy has value, this value is highly variable and rapidly declining as the penetration of roof-top solar increases, and now new challenges are emerging.

As the challenges facing the power system evolve and as the capacity of the energy resources at the distribution level increase, a new opportunity will be created. Distributed energy resources can be aggregated to participate in wholesale markets on the same footing as traditional transmission-connected generators, or to provide flexibility services to the local distribution network service provider as an alternative to traditional network augmentation.

These new markets for distributed energy resources can provide the incentives we need to retain customers on the power grid but will come at the cost of significant new complexity. (Challenge accepted!)

It used to be that energy was an operating expense.

Energy users purchased the energy they used because the energy commodity itself had a very complicated supply chain (mining coal, pumping oil, etc) and because energy infrastructure cost hundreds-of-millions to billions of dollars. This meant that only large energy providers and utilities with giant balance sheets owned energy infrastructure.

Now, energy is becoming an asset that energy users can own (flipping from OPEX to CAPEX). This is enabled by modern inverter-based energy systems that can be installed close to loads (avoiding transport costs and congestion), and because of zero marginal cost energy from renewable energy sources.

As energy assets become smaller, smarter, simpler, and cheaper, the number of individuals and organisations that will own these assets will grow exponentially.

This creates a commercial risk for large energy providers and utilities that are ‘long’ traditional centralised generation, transmission, and distribution infrastructure. We’re seeing these commercial challenges emerging already for owners of coal-fired power stations, but these challenges will only expand to include gas and other centralised generators, and in the long-run potentially even owners of transmission and distribution network infrastructure.

In fact, more progressive networks are deliberately replacing parts of their ‘poles and wires’ infrastructure with stand-alone power systems, and we think this is only the beginning of a radical reshaping of what it means to be a ‘network’ in the world of decentralised energy.

Not all energy users will want to own and operate energy assets directly, and there will be increasing innovation in third-party ownership and operating models: equipment leases, power purchase agreements, revenue sharing, virtual power plants, and more.

This creates a new commercial threat to incumbent energy providers, who in many cases are not used to competition. Confronting this challenge is the way forward for incumbents. A local energy system is effectively a substitute for both centralised network infrastructure and centralised generation infrastructure, so energy providers that want to own assets and supply energy will need to be prepared to own and manage much smaller assets then they are used to and be prepared to compete with a range of new entrants.

New ownership models are democratising energy, creating exciting new business models, increasing competition, and reducing costs for energy users.

The energy system is in transition, driven by three trends: decarbonisation, decentralisation, and digitisation.

The timing of this shift will vary dramatically by country and local area due to climate, existing infrastructure, market dynamics, and other economic, social and political factors.

But the direction of this shift will be the same everywhere: in the long-run almost all energy will come from small, smart assets distributed throughout the built environment. These assets will convert renewable energy to electricity, store that electricity, and automatically manage electricity use in response to dynamic market signals.

These same assets will be aggregated to participate automatically in wholesale energy markets and local network flexibility markets, which will help to balance supply and demand and manage the reliability and stability of local electricity distribution networks.

Our role at Gridcog is to provide confidence to the leaders who are investing in the new energy system.

We’re building a new technology platform to plan and optimise distributed energy systems. Our technology will determine optimal sites for deployment, choose the best possible combination and sizing of new energy assets, determine optimal control strategies for assets, explore market participation options, and automatically forecast and track commercial and environmental performance for every stakeholder.

This is our way of tackling the climate crisis and accelerating the transition to a new, clean and decentralised energy future.

A new energy future is coming, ready or not.

The latest Future Energy Scenarios from National Grid ESO anticipates a huge expansion in wind and solar capacity, from 35GW today to between 94GW-178GW by 2035. It envisions a critical role for distributed energy, smart charging, vehicle-to-grid (V2G), and demand-side flexibility - all key behind the meter themes. The business case and market size for behind-the-meter assets is getting stronger.

How to create a Financial Model for your energy project investment decisions using cashflow forecasts from Gridcog